Economics, in simple terms, is an aggregation of demand and supply. In a free market economy, if there is enough demand for a product, there will be companies that supply it. If the demand is high enough that signals a potential for high profitability, companies will be competing intensely to gain a share of the market, including making significant amount of investments in research and development and infrastructure however profligate it may appear to be.

A Forbes’ article by Beth Kindig reports that all big-tech companies including Microsoft, Goole, Meta, and Amazon have been spending hundreds of billions of dollars in AI infrastructure due to high demand for this technology. They are not only meeting this demand, but also investing beyond it. Big-tech CEOs unanimously say that failing to do so comes with the risk of falling behind their competitors. Google CEO Sundar Pichai is quoted as saying: “The risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing.” While these CEOs seem optimistic about AI’s profitability, from another perspective, they have no choice but to continue to allocate their capital towards AI.

Since they have already built extensive infrastructure like data centers, it is in these companies’ best interest to maintain public interest in AI, and attract users for their products. Since infrastructure for IT depreciates in value relatively quickly compared to other industries, as existing technologies get better, or new ones emerge, they need users for their existing infrastructure, and recover the cost of investment as much as they can. Yet, it remains uncertain whether they can achieve it.

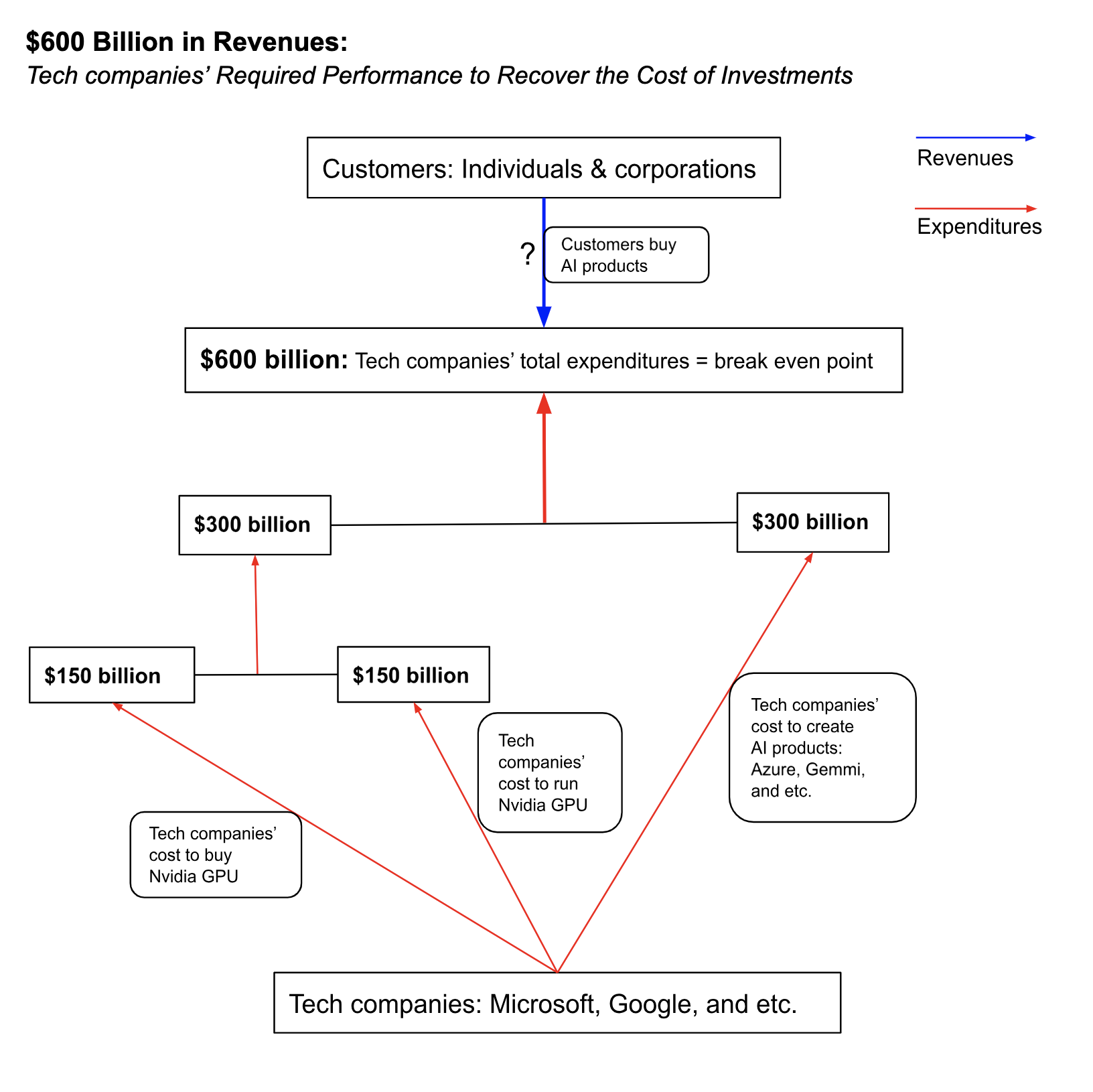

Sequoia Capital, a venture capital firm, expressed skepticism about the ability for companies to make enough revenues to justify their large investments. They estimated in their article that, for companies that use Nvidia’s GPU, an essential component to create AI products to make profits, they have to make over $600 billion in revenues before seeing any profits. They reached this figure as follows:

Nvidia, which makes GPUs that are widely used by tech firms to create AI products, is estimated to sell $150 billion of such products in the fourth quarter of 2024. For companies that buy them, including big-tech companies like Microsoft and Google, it costs them an additional $150 billion in energy to operate Nvidia’s GPUs. With the initial purchase of $150 billion of these GPUs and an additional $150 billion in their operational costs, the total cost of using Nvidia’s GPUs amounts to $300 billion. These companies then create their own AI products, examples of which include Microsoft’s Azure and Google’s Gemini, and sell them to end-users, such as individuals and corporations. It costs them $300 billion to create, maintain, and market such AI products. In order to breakeven, Sequoia estimates they will need to generate $600 billion ($150 billion in Nvidia GPUs, $150 billion in running them, plus $300 billion in creating and maintaining firm-specific AI products) in revenue.

Since the primary objective of publicly traded companies is to increase their stock prices to benefit their investors, they are looking for profitability of these products. While companies have been enjoying heightened interest of the public in AI, in order to maintain their interests and investments in their stocks, these companies will need to successfully monetize their AI products. However, besides Chat GPT, created by Open AI, there have not been other AI products that are widely used and recognized by the public. Open AI also generates much greater revenue of $3.5 billion, compared to most startup AI firms, which is typically less than $100 million. Under these circumstances, generating a $600 billion revenue from AI, as the IT industry as a whole, currently seems difficult to achieve. While Nvidia has led the surge in stock prices big-tech firms, this sector’s future rest not only on other IT firms’ capabilities, but also on the performance of the general economy.

In the last two years, QQQ, an ETF whose top ten big-tech holdings comprises 50% of its value, has grown 36%, outpacing S&P 500 (25%) and Dow Jones (17%). While there are investors who views their investments in the long-term, many others look for short-term quarter-to-quarter revenue growth. They may start divesting from the AI market if they believe that these companies cannot deliver profitable products. Furthermore, if the economy goes into a recession, the technology sector, which has grown faster than other segments of the economy, may experience similarly faster decline. Therefore, it is necessary to assess the current state of AI and where it might be headed, detached from the elevated general public sentiment.

Schedule a call with me here.

One thought on “AI’s Profitability Questioned – How It will Affect Tech Stocks ”