The stock market in 2023 recovered much of the losses from the downturn of 2022, before it reached its record highs in 2024. The S&P 500 had a 26% return in 2023, rebounding from an 18% loss from the previous year. More impressively, the largest 50 companies within the S&P 500, rose by 38%. Having seen such performance in the past year may cause investors, particularly newcomers, to expect consistently high returns.

Recently, I engaged in a conversation with a prospective investor who was targeting a 10-20% return on investment. When we consider the historical performance of the S&P 500, it has delivered an average annualized return of approximately 9% over the last two decades. Some other fund categories, including the large-cap growth stocks yielded more, reaching as high as 10.5%. Consistently achieving 10-20% annual returns would thus entail surpassing these already excellent market average. Since my approach is building and preserving clients’ assets with the movement of the general market, I informed him that it was not something I was able to deliver.

However, there are actively managed funds designed to pursue such above-average returns. Rather than adopting a buy-and-hold strategy, managers of these funds engage in opportunistic buying and selling, often in the short term. Contrary to these funds’ purpose, research indicates that the vast majority of them fail to consistently outperform the market.

S&P Global’s SPIVA (S&P Indices Versus Active) is a research comparing the performance of actively managed funds to indexes over 20 years. Its 2023 study revealed that 60% of actively managed large-cap funds, to which the S&P 500 belongs, underperformed the benchmarks that year.

The SPIVA study classifies stock funds into 22 different categories, such as by size of market capitalization and by metrics including the P/E ratio of the underlying stocks. Analysis reveals that over one year, funds in 6 out of 22 categories underperformed less than 50% of the time, in other words, more than half of the funds in these categories outperformed the market.

Despite this short-term outperformance in select fund categories, the picture changes over longer time horizons. Over five years, only 1 out of 22 fund categories had more than 50% outperformance. Extended to over 15 years, no fund categories achieved this, with 21 out of 22 experiencing 75 to 100% underperformance.

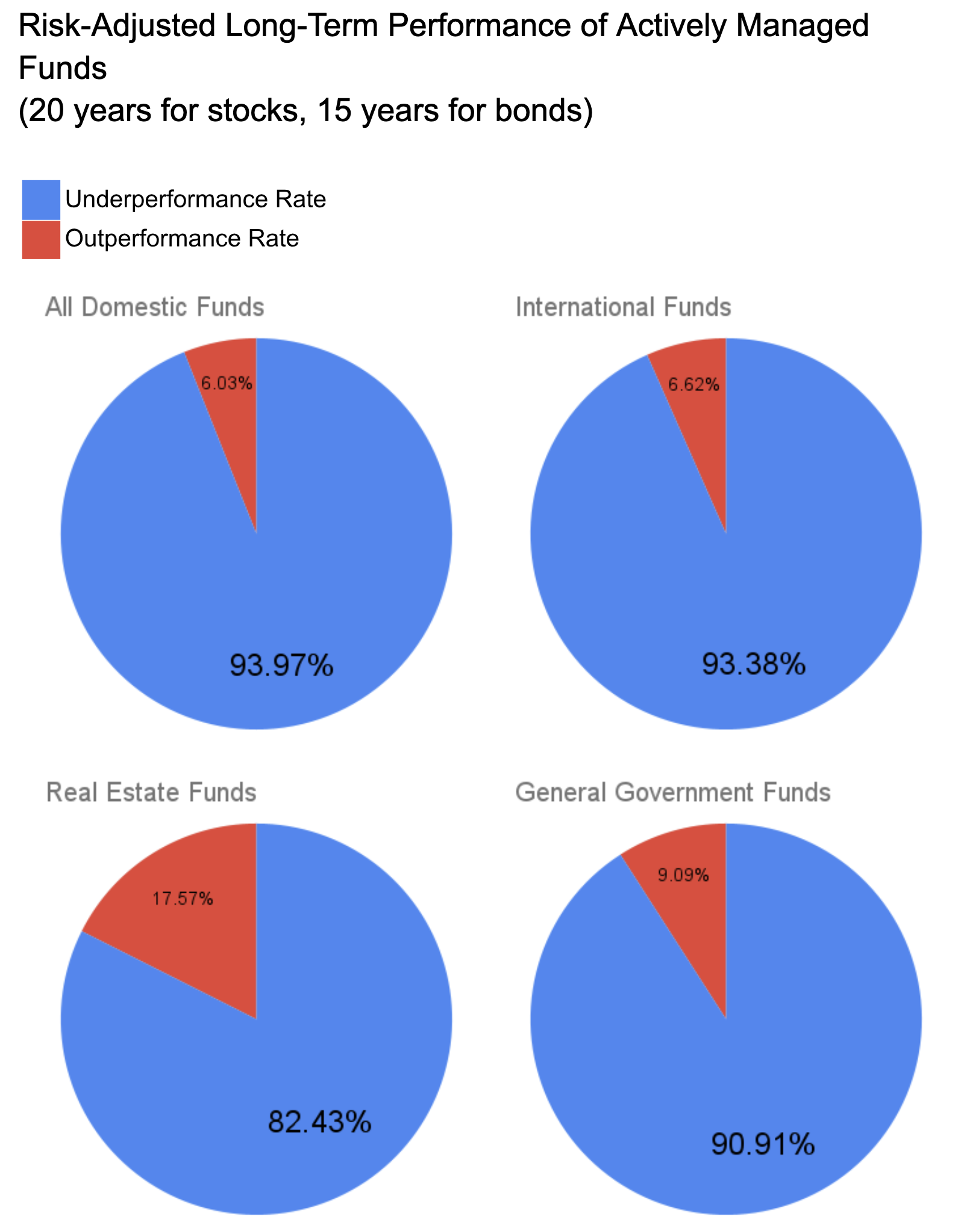

The chart below shows how actively managed funds in different asset classes fared over 15-20 years. Stock funds and bond funds both performed poorly, with over 90% underperformance. While there were better performers, such as high-yield bond funds whose rate of underperformance was 63.5%, the pattern is clear; the longer the actively managed funds are in existence, the higher the probability that they will underperform market indexes.

As a result of underperformance, investors tend to withdraw their money at a loss, leading to a decline in the funds’ survivorship rate. Over 20 years, only 34% of the initially studied 2,337 actively managed funds remained operational. Additionally, they often charge 10-20 times more in mangement fees than low-cost passively managed funds do. These high expenses further reduce their likelihood of delivering above-average returns.

While this reality may be disappointing, understanding it can be a strength to investors. Fear and greed are two of the psychological states that often make investors commit errors. Accepting average market returns tempers greed, and allows for an agreeable investing experience in the long-run.

Continue the conversation with me here.

One thought on “Can Actively Managed Funds Outperform the Market? Study Shows They Cannot Most of the Time”