We often hear the term, “diversification”, concerning investments. This strategy often involves spreading risks in various asset categories, not only in US stocks, but also international stocks, bonds, real estate, commodities and others. However, many people exclusively consider the S&P 500, a major US stock index, when thinking about investments, despite the availability of other options.

One reason for this focus on the main US stock exchange, may be its frequent media coverage, since it represents the largest firms in the country, and has historically delivered high returns. While people commonly assume US stocks always yield the best returns, this has not always been the case. This article will address three misconceptions about stocks and how individuals can navigate today’s economic conditions.

Misconception 1: Stocks always perform better than bonds in the long-term

Examining the returns of US stocks over the most recent 30 years from 1994 to 2023, one may be persuaded that stocks are a superior investment to other asset classes. During this period, US stocks yielded an annualized return of 9.92%, while long-term bonds have returned 5.15%. However, there was a 30-year timeframe in which stocks underperformed bonds.

Between 1982 and 2011, which likely encompassed the majority of working years for many individuals, long-term bonds outperformed US stocks. During this period, stocks, while still lucrative, yielded an annualized return of 10.47%, slightly less than the 11.15% yield of bonds. Such a result contradicts the common belief that stocks always generate higher returns than bonds, especially in the long term.

Misconception 2: Stocks always recover from a crash quickly

Investment advisors and sophisticated investors often view a market crash as an opportunity to invest, operating under the belief that that the market will inevitably recover. Their assumption is partly correct; typically, in the US, recovery occurs within three to four years. However, there are exceptions to such trends. For instance, it took US stocks 29-years, adjusted for inflation, until 1958 to recover from their peak in 1929, right before the Great Depression.

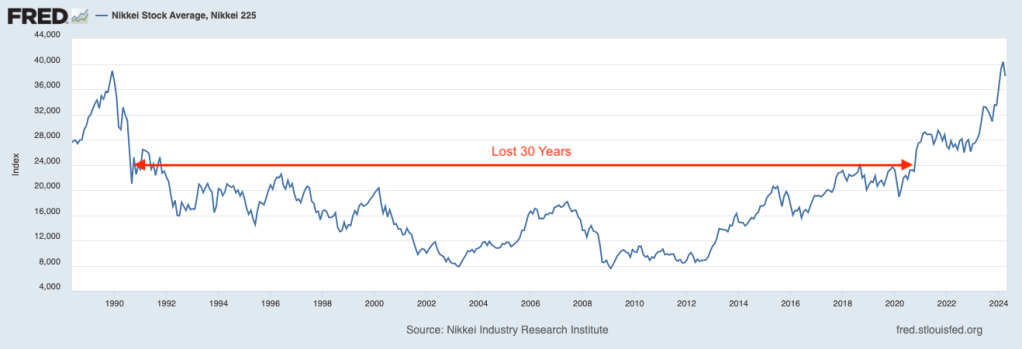

Another example is the Nikkei 225, Japan’s major stock index. After its stock market bubble burst in 1991, the Nikkei 225, which peaked at 39,000 in December 1989, plummeted to as low as 7,862 in the early 2000’s. It took over 35 years until 2024, for it to finally surpass its 1989 peak.

As Japanese companies have been posting record profits in the last few years, partly owning to the weak yen, the country appears to be emerging from its persistent economic stagnation. However, despondency had greatly outweighed optimism for decades, during the period known as the “Lost Thirty Years.” Considering these historical precedents, we cannot dismiss the possibility that a long-term economic and market stagnation could occur in the US in the future.

Misconception 3: Stocks have entered a new era of growth

In 2023, approximately 30% of the firms represented in the S&P 500 were IT companies, a significant increase from about 10% in 2013. Unlike companies in the manufacturing sector, such as car makers, IT firms can expand businesses more efficiently than other sectors, as they require significantly less physical capital and labor. Due to the greater economy of scale the IT sector enjoys, investors anticipate that its profits will continue to grow, justifying paying higher stock prices, as expressed in the PE ratio, than stocks in other sectors.

Furthermore, during a market rally, the media amplifies investors’ optimism with positive reports on the market outlook, drawing further investments and pushing up asset prices. Consequently, investors often believe that the market will rise perpetually, perceiving a fundamental shift in market conditions. Robert Shiller refers to such an optimistic disposition, detached from historical perspectives as “New Era Economic Thinking.”Even eminent scholars have erroneously subscribed to this idea, such as when economist Irving Fisher famously declared in 1929 that stock prices had reached “what looks like a permanently high plateau” just before the market crash.

When a new booming sector emerges, people often believe that this time is different, and the new trend will persist. However, throughout history, whether it’s the crash of 1929, 2000, or 2008, assets that have gone up dramatically have eventually reversed. We may witness a similar outcome in the current market, which has appreciated greatly, partly due to the investors’ positive outlook on the development of artificial intelligence.

What investors can do in the current economy

In the spring of 2024, market sentiment turned negative due to rising inflation. The Federal Reserve (the Fed) had previously anticipated that inflation would diminish toward 2% a year, prompting consideration of cutting the interest rate. Despite having the highest interest rate in the 21st century, the inflation rate still hovers around 3.5%, giving the Fed with a policy dilemma: the cost of borrowing for the US government has become unsustainably high, necessitating them a series of interest rate cuts, but doing so will exacerbate inflationary pressure.

On the surface, the economy appears to be robust, with the unemployment rate below 4%, but there are signs of underlying problems. A principal issue is that debt, not savings drive both government and consumer spending. The US government debt stands at around $34 trillion as of April 2024, an increase of more than 45% since 2020, and consumers carry over $1 trillion in credit card debt. Additionally, pressure mounts on the US to provide aid to Ukraine and Israel, yet doing so risks undermining the restrictive monetary policy the Fed has been implementing to reduce inflation.

In an economy teetering on the edge, no single strategy could shield one from the ongoing challenges. However, what we can do is to follow the proverbial advise to “not put all your eggs in one basket” , or to diversify. This diversification strategy involves not only investing within US stocks like the S&P 500 but also covering much of the broader investment universe.

A strategy I’m currently employing in my own investments, which may change with the market condition, is to take advantage of the high interest rate, and invest a sizable portion of my new funds in the money market.

Continue the conversation with me here.