From 1990 to 2007, the size of the finance industry grew at a rate that was 64% faster than that of the entire economy. This rapid expansion of the financial sector, which occurred without proper oversight, played a significant role in triggering one of the most severe economic downturns in history in 2008. The aftermath of this recession left a lasting impact, fostering distrust and resentment among the public towards the finance industry. The documentary made by PBS titled The Retirement Gamble, created a few years after the crisis, depicted the discontented hard-working people who had been sold unsuitable financial products, leaving them in the dark about their investments.

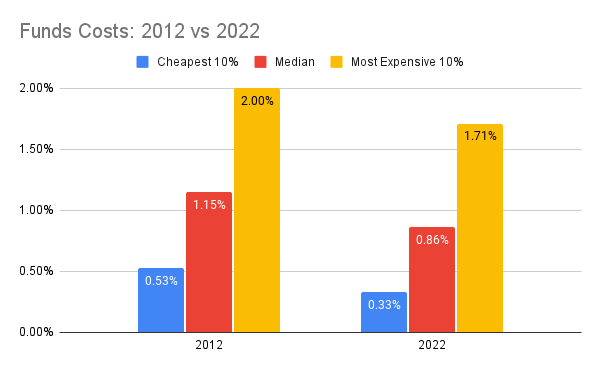

Despite the widespread availability of the internet in the early 2010s, there existed a profound informational asymmetry between finance professionals and the general public. It was a common practice then that investment products used in retirement accounts, such as 401k, as well as in individual brokerage accounts, unbeknownst to investors, had excessively high management fees. Combined with additional fees paid to administrators of these accounts, including financial advisors, the total management cost could exceed 2% of the portfolio value. The journalist in the documentary is shocked to discover how the cost of 2% a year, seemingly a small number, can significantly diminish one’s investment returns in the long run, due to its compounding effect.

The film further reveals that most managers of actively-managed mutual funds, which are designed to outperform major market indexes such as the S&P 500, fail to achieve this intended result most of the time. The data indicates that investing in passively-managed mutual funds that simply track the index yields better returns. Confronted by this fact, an active-fund manager interviewed in the film could only assert these funds had a place in clients’ portfolios, and was unable to provide evidence to support this claim.

Since the early 2010s when the documentary was released, the public has become better informed about financial products, and Wall Street firms have started to address this narrowing informational gap. In the 2020s, it is rare to encounter mutual funds with loads, which are fees typically deducted upfront, and the expense ratio, the funds’ ongoing management fees, has been decreasing. In addition, more money is flowing into low-cost funds than into high-cost funds. These trends highlight a substantial improvement in the environment for investors in terms of the quality of investment products available.

What has little changed since the documentary was made is that it still requires investors to take extra caution when working with finance professionals. In 2022, only estimated 5-7% of financial advisors were fiduciaries, who are legally obligated to prioritize their clients’ best interests. The rest of the advisors fall into the category of brokers, who do not have a legal obligation to do so. While these brokers may be likable individuals, good parents, and respected members of their communities, when it comes to their client relationships, they are often guided to prioritize their personal and corporate interests, which may not align with those of their clients.

Despite improvements in the investment environment over the past decade, the reality of the current state of finance professionals is such that many of them still lack the level of transparency clients need. However, as the average level of financial knowledge among investors increases, so does their ability to identify a good advisor. Therefore, conducting due diligence can provide investors with greater confidence that their retirement is no longer a gamble.

The documentary The Retirement Gamble is available here.

Continue the conversation with me here.

One thought on “The State of Finance Professionals – A Decade After the PBS Documentary “The Retirement Gamble””